Payroll online calculator 2023

It will be updated with 2023 tax year data as soon the data is available from the IRS. Calculate how tax changes will affect your pocket.

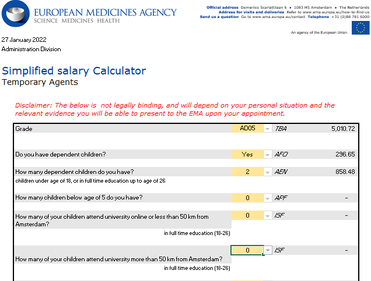

Calculators Of Salaries In Eu Institutions European Union Employment Advisor

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

. Get Started With ADP Payroll. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which. Ad Compare This Years Top 5 Free Payroll Software.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Our online calculator helps you work out your. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Taxes Paid Filed - 100 Guarantee. Louisiana paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Ad Process Payroll Faster Easier With ADP Payroll.

Try out the take-home calculator choose the 202223 tax year and see how it affects. Get Started With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

Prepare and e-File your. Employers can enter an. UK PAYE Tax Calculator 2022 2023.

The standard FUTA tax rate is 6 so your max. See your tax refund estimate. Sage Income Tax Calculator.

Ad Plus 3 Free Months of Payroll Processing. Use our PAYE calculator to work out salary and wage deductions. See where that hard-earned money goes - with UK.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Discover ADP Payroll Benefits Insurance Time Talent HR More. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

The National Insurance class 1A rate for 2022 to 2023 is 1505. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. A tax calculator for the 2023 tax year including salary bonus travel allowance pension and annuity for different periods and age groups.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Well calculate the difference on what you owe and what youve paid. Payday filing through file upload services.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Use our employees tax calculator to work out how much PAYE and UIF tax you. Free Unbiased Reviews Top Picks.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The payroll calculations business rules define the tax rates and thresholds tax types business rules and calculations needed for specific tax codes. Employers and employees can use this calculator to work out how much PAYE.

Its so easy to. In 2023 these deductions are. FAQ Blog Calculators Students Logbook.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Ad Process Payroll Faster Easier With ADP Payroll. Ad Plus 3 Free Months of Payroll Processing.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. It will confirm the deductions you include on your. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Deductions from salary and wages. Prepare and e-File your. Free salary hourly and more paycheck calculators.

Taxes Paid Filed - 100 Guarantee. This Tax Return and Refund Estimator is currently based on 2022 tax tables. If youve already paid more than what you will owe in taxes youll likely receive a refund.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages each pay period. Free Unbiased Reviews Top Picks. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

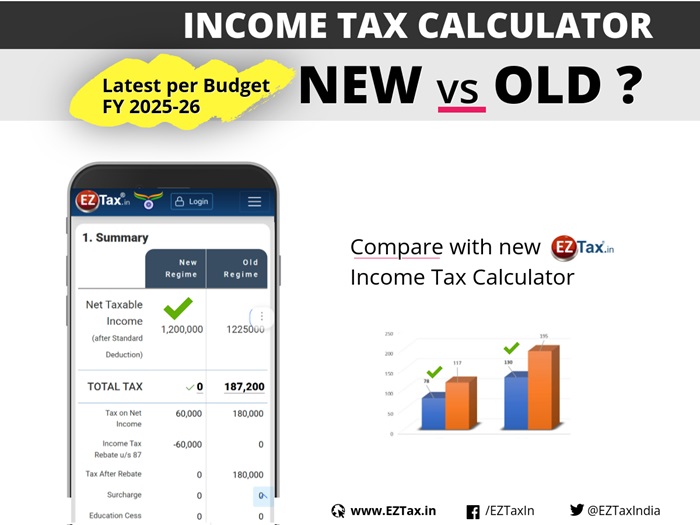

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

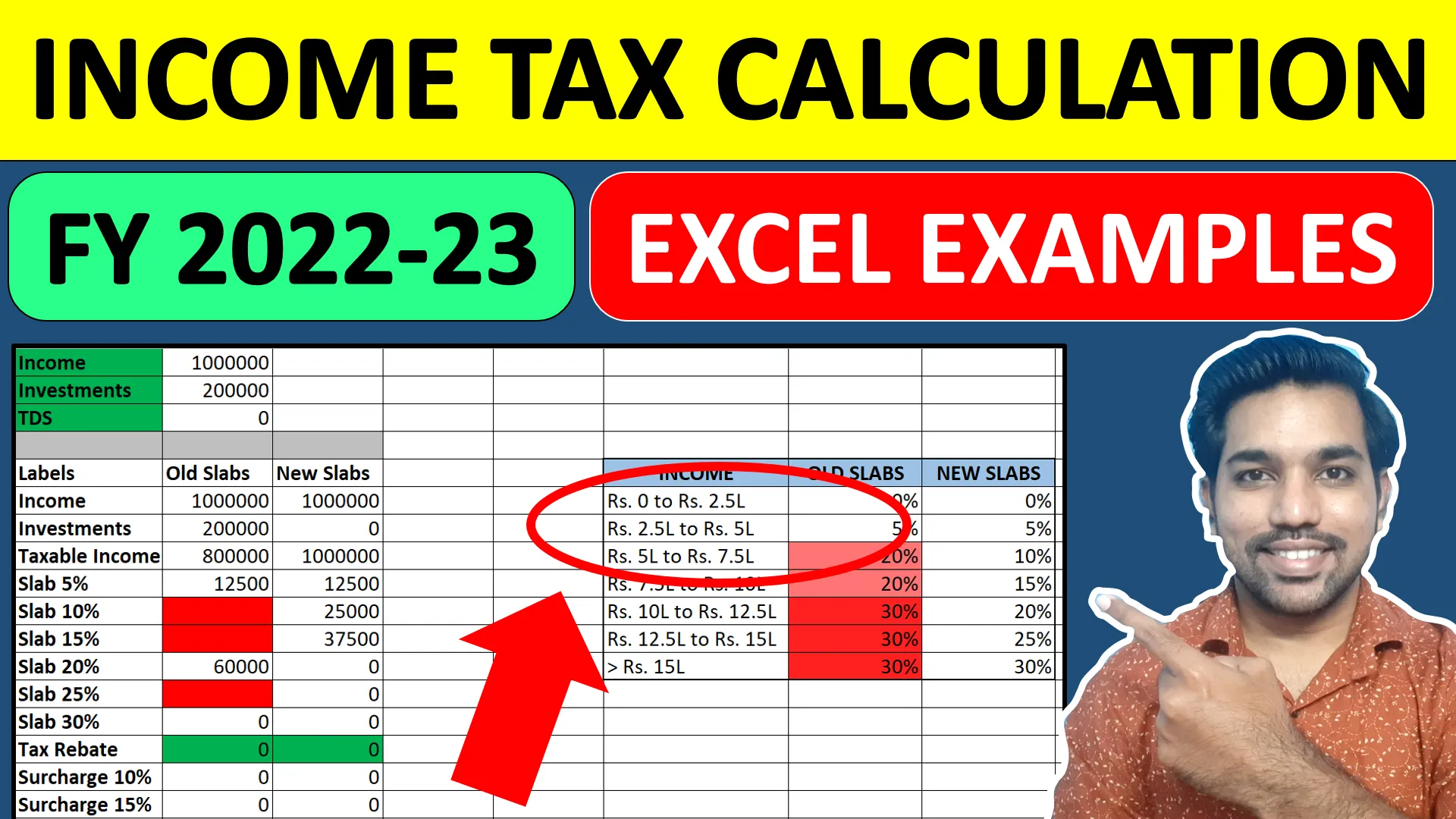

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

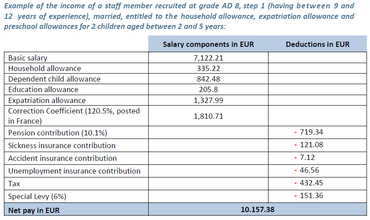

Salary Calculator Statistics Explained

Calculators Of Salaries In Eu Institutions European Union Employment Advisor

Income Tax Slabs 2022 23 Pakistan Salary Tax Calculator

Tax Calculator For Netherlands Salary Calculator 2022

Uk Salary Calculator 2022 23 By Rhys Lewis

Calculators Of Salaries In Eu Institutions European Union Employment Advisor

Grade Book Templates 13 Free Printable Doc Pdf Xlx Grade Book Grade Book Template Templates

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

Salary And Tax Deductions Calculator The Accountancy Partnership

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

How To Calculate Foreigner S Income Tax In China China Admissions

Business Days Calculator Calculate Working Days In A Year

Want To Work Out Your Gross Vs Net Salary In The Netherlands Here We Ll Tell You How Page Personnel

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms