34+ how to not pay mortgage insurance

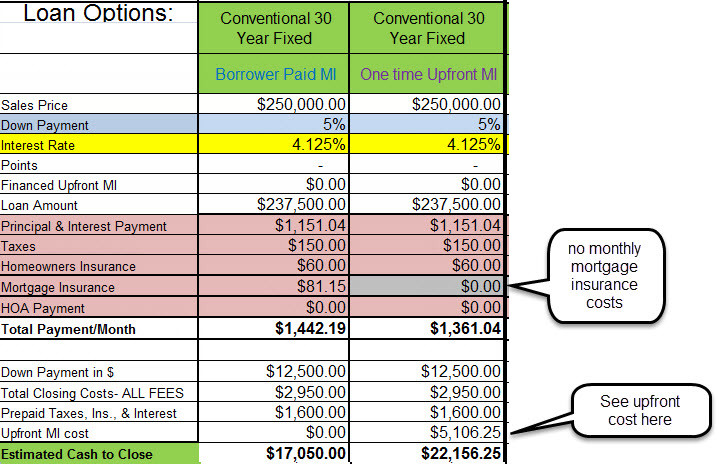

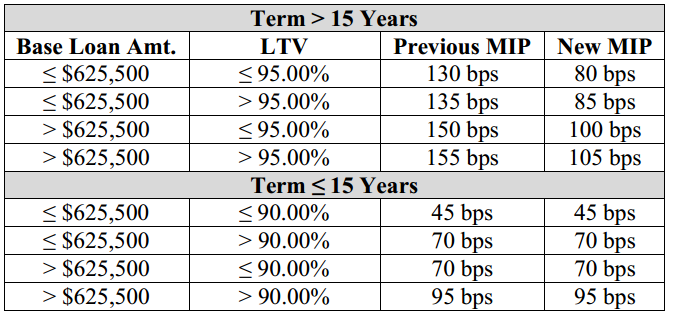

First theres an upfront mortgage insurance premium of 175 of the total loan amount. Web If youre taking out a government loan an FHA loan for example the same concept applies but the lenders insurance is just called mortgage insurance.

Next Generation Filmakers 021920 By Toronto Caribbean Newspaper Issuu

Web Here are ways to avoid paying for private mortgage insurance.

:max_bytes(150000):strip_icc()/shutterstock_431846191_mortgage_insurance-5bfc3173c9e77c005180e01a.jpg)

. Web There are two components to FHA mortgage insurance. Web Depending on the policy mortgage insurance may pay off the entire mortgage at once or it may pay the mortgage off over a period of time such as five. Web If you maintained an escrow account with the bank and made regular deposits for the payment of taxes and insurance the Real Estate Settlement Procedures Act RESPA requires the bank to make timely payments of these items from the account.

If the bank does not pay the insurance premium when it is due and the policy is canceled the bank must. Our Simple Guide Will Help You Understand Common Mortgage Terms. Web Another way to avoid PMI is by using a piggyback mortgage.

Web Mortgage insurance also is typically required on FHA and USDA loans. Web The passive way to get rid of insurance is to make mortgage payments every month until you have 22 equity. Web One of the easiest ways to avoid paying mortgage insurance is to keep your credit record clean.

Web Private mortgage insurance is insurance for the mortgage lender and wont cover your home in any way. Understand The Home Buying Process Better. Web When you finance a home purchase part of your monthly payment may go toward an escrow account which the mortgage company will use to pay homeowners insurance.

Web Mortgage insurance allows you to purchase a home with less than 20 down as opposed to trying to save another 12 months for a down payment. Show little debt and lots of fiscal responsibility when applying for a mortgage loan. Lenders view a mortgage loan with a smaller down payment as a.

Make a 20 down payment A larger down payment offers advantages beyond lowering the monthly mortgage payment and avoiding PMI. This is a unique loan structure where the buyer needs only 10 down in cash. Federal law requires your lender to cancel PMI.

Mortgage insurance lowers the risk to the lender of making a loan to you so you can.

Mortgage Insurance When Do You Need It New Dwelling Mortgage

How To Get Rid Of Mortgage Pmi Payments Bankrate

How To Remove Pmi Moneyunder30

Economic And Social Data Service Esds

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

How To Get Rid Of Mortgage Pmi Payments Bankrate

What Is Mip Mortgage Insurance Premium

Pmi Back To Basics For Private Mortgage Insurance Or Not Mortgage Professional

Getting Started Post Office Money

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

The Mortgage Brothers Show Signature Home Loans Phoenix Az

How To Avoid Pmi When Buying A Home Nerdwallet

Home Insurance What To Know About Homeowners Insurance

:max_bytes(150000):strip_icc()/Colonialhouse-a1de8e9a6f464661bdb42f36e4ba074c.jpg)

How To Outsmart Private Mortgage Insurance

How To Avoid Mortgage Insurance In 6 Ways Rwm Home Loans

Fha Approved Condos Why Approval Is Vital For Buyers And Sellers

Fha Slashes Mortgage Insurance Premium How Much Will You Save California Mortgage Broker